Although it took more than a year, the new healthcare project created by three industry titans to lower health care costs finally has a name… and it’s not what we’ve been expecting.

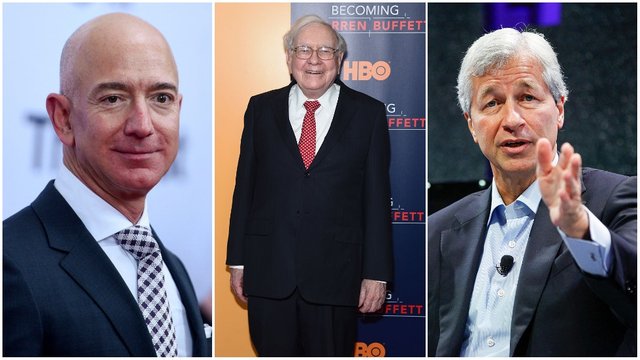

The Bezos, Buffett and Dimon healthcare venture now has a name

On the 6th of March, the non-profit venture was officially christened “Haven,”, living by the motto of making healthcare simpler, better, and lower cost, for the 1.2 million employees and families affiliated with Amazon, Berkshire and JPMorgan it serves.

On its newly launched website, the Haven team broadly outlined its strategy to harness the power of data and technology to cut costs and improve healthcare outcomes.

“Haven was formed by the leaders of Amazon, Berkshire Hathaway, and JPMorgan Chase because they have been frustrated by the quality, service, and high costs that their employees and families have experienced in the US health system,” Haven CEO Atul Gawande wrote in a message on its website, which was unveiled on Wednesday. “They believe that we can do better, and in taking this step to form this new organization, they have committed to being a part of the solution.”

“We want to change the way people experience health care so that it is simpler, better, and lower cost,” Gawande said in a statement on Wednesday. “We’ll start small, learn from the experience of patients, and continue to expand to meet their needs.”

Prior to the big reveal, many industry insiders referred to the venture as “ABC” or “ABJ.” The company said the name choice of “Haven” lines up with its mission to be a “partner” to care providers and to focus on the health-care needs of the 1.2 million Amazon, Berkshire Hathaway and J.P Morgan workers. Since his appointment, Gawande has been meeting with employees at these three companies to understand their health-care experiences.

The non-profit company has been shrouded in mystery since it was first announced in January of 2018. Gawande, a renowned surgeon and author, has said little since he was hired last summer. It faces a herculean task since rising health care costs are one of the nation’s thorniest problems. Other companies have tried — and largely failed — to truly make a dent in their spending.

Haven is aimed at improving the overall healthcare system and making it more affordable

The venture’s name reflects its goal to help individuals and families get the care they need and to work with doctors and others to improve the overall system, according to its website. Its focus is the 1.2 million employees and dependents of Amazon (AMZN), Berkshire Hathaway (BRKA) and JPMorgan Chase(JPM), though it says it will share its knowledge with others.

“The good news is the best results are not the most complicated or expensive,” said Gawande, who has been meeting with the companies’ workers to learn more about their health care experiences. “The right care in the right place is often more effective and less costly than what we get today.”

The Boston-based company aims to make primary care easier to access, insurance benefits simpler to understand and use and prescription drugs more affordable, the website says. It seeks to harness data and technology to make the overall health care system better. It notes that solutions may take time to develop.

“We believe it is possible to deliver simplified, high-quality, and transparent health care at a reasonable cost,” the site says, noting that those who have a regular and reliable source of care and can afford medications and treatments can live more than 80 years, on average, and enjoy a better quality of life. But many Americans don’t have these basics.

A chance for transforming the healthcare system

From its starting point, it was claimed that the new founded company would be “free from profit-making incentives and constraints.” Obviously that skeptics have questioned whether the grandiose vision could be achieved, with some suggesting the whole enterprise may ultimately prove to be little more than an effort to push insurance costs down for the three companies.

But recent moves, especially concerning leadership, suggest the trio are serious about actually making a change. Certainly they can use their combined power to get better prices. But they may also be able to apply pressure to an industry rife with inefficiencies. Middlemen abound in the health care sector, raising costs for everyone without contributing to an efficient health care market. If the new venture can succeed in curtailing the value extraction alone, it could mean a 15-20% reduction in health care costs. That would be huge for employees.

The real question is whether any success of the three companies in reducing structural costs of health care could, given their combined footprint and influence, radiate outward to the rest of the market. They have a grand ambition and it may prove a serious challenge even for the likes of them. But it is rarely a good idea to bet against Buffett, Bezos or Dimon. Even less so to bet against all three at once.